television services payment n reached 1746.8 million, an increase of 2.5%, exceeding for the first time to the TV in open.

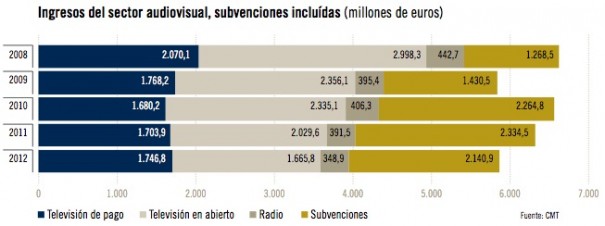

According to data of the report EconÃ-economic and Sectoral 2012 presented this MIA © Wednesday in the Senate by the commission of the Telecommunications Market (CMT) the total revenue of the sector of television and radio were of 3761.4 million, with a fall of 8.8% annually, driven in large part by the decline in advertising revenues, which were down 17.3% to 1,925 million euros.

TV in open invoice ³ 1665.8 million euros (17.9% less than in 2011) and television services payment n reached 1746.8 million, an increase of 2.5%, and for the first time exceeded those of the TV in open. However, the number of subscribers descended on 340 522 for all pay TV technologies.

October 2012 culminated the merger between Grupo Antena 3 and Management of Audiovisual Services the Sixth, who along with Mediaset Espaà ± a (result of the merger between Gestevisià ³ n Telecinco and Cuatro) accounted for 82% of the investment n advertising.

n

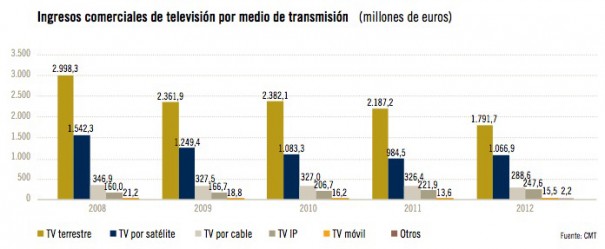

evolution in the past few years ± os sector n television shows as the main trend of interest © s the fall continued in revenue. Since the beginning of the economic crisis in 2008, commercial revenues of the air channels decreased from 2,998.3 to 1665.8 million in 2012, primarily as a result of reduced advertising activity. Although the television n pà º à Republic of national scope, RTVE, let ³ of broadcast advertising in 2010, the rest of televisions, far from improving revenues, saw its sales n reducÃa billing. While the transition n to DTT opened ³ the possibility of many new channels and agents, the fall pronounced in advertising revenue with processes concentracià ³ n have led to a Reduction of the number of operators in this sector.

s

addition, in 2012 and due to the current context n Decrease government spending, subsidies also © n sector have decreased: 8.3%. This, together with the fall of the billing n trade, especially important for operators television n pà º Republic autonomic, has resulted in the need for these, adjustment important, therefore reducing their workforces as the benefits they provide to users. Note that the main channel TVE generalist, the 1, has moved from the first position at the statistics of share to the third, after Telecinco and Antena 3.

segment television No payment was not immune, according to WCL these circumstances: the crisis with its impact on household income, turned out in a decrease n in the number of subscribers, while revenue grew moderately . In this segment, initially dominated by a single satellite platform, the entry of telecom operators has resulted in a lower market concentracià ³ n. The operators offering broadband and television Telephony n Pay have been gaining up to late 2012 s more than 50% of total subscribers to pay television n.

A clear trend is detected in the last few days is the presence of new agents offering content services using the Internet as a distribution n. Providers is OTT (over-the-top services). The latest Survey on Equipment and ICT household INE be ± praises that in the last quarter of 2012, 50.6% of Internet users They’d eaten contained either radio or from TV in streaming Trava © s network. OTT content providers have very different business models of traditional as it is the user who chooses the time, the content, the terminal and place. It is a distribution n of increasing use, especially among the population most s n young. The services of this type are included in this report only in cases where operators are those TV in open television platforms n Pay who offer them.

environment economic crisis ³ affecting the overall economy in 2012 incidia ³ income earned by the operators of television and radio, with a turnover of 3761.4 million. This represents a decrease of 8.8% compared to the turnover achieved in 2011.

Previous income figure does not include grants received by operators venues around à state level and autonomic-economic. In 2012 these were de2.140, 9 million euros (which implies a decrease of 8.3% year n). If you include these grants, revenues totaled audiovisual 5902.4 million euros, 8.6% less than in the previous year.

general terms, all operators scored setbacks in their income over 2011 figures. Públicos operators were reducing the amount of subsidies received, ³ What adds to the fall in advertising revenues. Some of them shut down part of their emissions or canceling second channels regardless of their Emisia ³ n to Trava © s of other platforms like television n by satin © lite. Meanwhile, private operators were affected by lower advertising revenue and contraction n in the subscriber base subscribed to pay TV services.

biggest decline in revenue over the previous year as the segment undergoes ³ n in open television (DTT), according to ne l Report of the CMT. This segment, whose revenues come primarily from advertising investment n perceived, downgraded 17.9% compared to 2011 and earned a total billing n 1665.8 million.

Pay TV

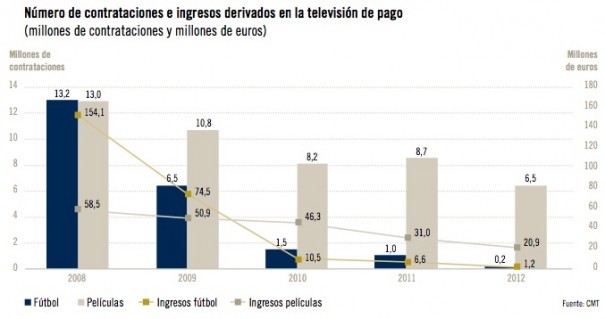

television services n Pay, which base their business model on subscription revenue n (in meeting the fees be paid for their service scribed), behaved contrary.

In 2012 the income from these first exceeded turnover segment TV in open. So, after some growth â €? 2.5% â €? over the year ± or earlier, the television segment n Pay won a global billing n 1746.8 million. It should be noted, however, that this increase in billing n did not involve an increase in the customer base, but, on the contrary, was accompanied ± ado by pà © loss overall 351 635 subscribers, including access to television n out cellphone.

For The decrease in the customer base of service television n Pay, according nl CMT, could be related to two facts: first, with the stage of crisis and fall of the GDP, which is negative for with most of the families, and secondly, with the rise of indirect taxes in 2012 that affect this type of service.

2012 volume figures incomes television services n-air and pay television n converged. This convergence should not be ³ to increased television revenue n Pay, but more s either the fall that revenue from TV in the open have been experiencing in the last few years.

Radio

Radio

The third and last great à º à business area within the audiovisual services chapter â €?’s Radioa???? © n ³ also accuses the fall in advertising revenues and, in 2012, earned 348.9 million euros, 10.9% less than in 2011. S Once again, the main cause of this decline lies ³ in which advertisers spent less advertising investment n the mass communication.

If we analyze the origin of the audiovisual sector revenues, it appears that the game that more s ³ impacted on the decrease billing n compared to 2011 was the advertising revenue. With a decrease of 17.3% over the previous year ± or, involved a total of 1,925 million euros, it meant ³ 403 million less than the previous year.

The other big itemforming audiovisual revenue â €? subscriber fees television services n Pagoa???? ³ advances slightly (by 1.4%) in 2012 and reached 1,492.5 million ³ the euro, despite the pà © loss of 351,635 subscribers.

September, services television No payment went to tax the super-reduced rate of VAT (8%) to do with the standard rate of VAT, which under the new rules went up from 18 to 21%. In this regard, studies Household Panel CMT indicate that many households espaà ± oles the high price is the main obstetric services ass to hire n Pay television.

Meanwhile, revenues from pay-per-view and video on demand, being recorded descents from the year ± o 2008, were due primarily to rent movies and other events (concerts, TV series and sports unrelated the football competitions). In 2012 this game recorded a further decline of 28.9%, reaching ³ an overall figure of 29.9 million euros. Of these, 20.9 million belong to the vision of movies, 7.8 “other events” and “other sports” and 1.2 million futbolÃsticos events. It should be noted that since 2010 the contents related to football are marketed mostly to Trava © s of monthly subscriptions to channels and payments based on vision.

Broadband

Broadband broadband mobile phone for It became the engine of the telecom sector in 2012 as it was the only business segment who got increase billing n, to 2766.6 million euros, 29% more s than in the year ± or earlier, to a penetration of 54% n. Also during the year ± or a total of 24.9 million lines more Automobiles, (44.2% more s than in 2011) agreed actively to Internet mobile phone for, according to data from the Report EconÃ-economic and Sectoral 2012 launched today in the Senate by the commission Telecommunications Market. The growth of broadband mobile phone for was insufficient to offset the heavy drapes of income in the other services, so that the industry as a whole bill ³ 35228.3 million euros, 7.2% less than in 2011.

context of economic crisis and widespread decline in prices for telecommunications services did that overall industry revenues fall in Espaà ± a. The revenue decline by more s remarkable occurred in the mobile phone for Telephony (voice and SMS), which doubles ³ the fall suffered in 2011, to 9504.5 million, down 15.9%. The fixed telephony revenues fell by 10.7% to 4813.9 million, while fixed broadband ³ recorded a fall in billing n from 4.6% to 3.659 million. Meanwhile, enterprise communications billed 1.497 million, down 0.3%.

nTotal investment by sector operators overcame 4,000 million â, ¬. Regardless investments radioelà © electric spectrum, the n descended investment by 8.9% over the year ± or earlier. Direct employment stands at 66,847 workers ³ (-10.7%).

Competition between theDuring 2012, is accentuated According ³ n CMT competition, so that there were more s portability 7 million (5.2 million more portability portability Automobiles and 1.8 fixed). Alternative operators, with smaller market shares-were the ones who captured a higher percentage of lines (in mobile phone for, the OMV and Telstra scored a net gain of 1.15 million lines, in fixed, Jazztel leads ³ volume portability 268 723 positive portability) while major operators reduced their market share. This resulted dynamics also © n at leading price reductions for users.

price decreases mainly materialized several AAV packaging services, with a final price substantially lower than the individual contratacià ³ n different services. So, for example, the actual total expenditure of households who hired the package fixed broadband and voice (the more s sued to 7.7 million subscriptions) fell 6.9% over the year ± or (until 35â? ¬ on average). In 2012, joined also © n packages combining broadband mobile phone for fixed network services (What druple and quÃntuple play), with more s than 1.2 million subscribers at the end of year ± o.

s

addition, operators continued to reduce final prices NDOS supports the decrease of wholesale prices regulated by the CMT. So, for example, were especially relevant the falls from 13.8% to 11.2 © ntimos comfortable â ¬ / minute in the average price per minute for calls from web bound mobile phone for domestic (fixed or mobile phone for) . For calls originating from fixed network to a destination mobile phone for the average price fell to the comfortable 13.3 © ntimos / â ¬ min, 11.1% fewer than in 2011.

The lines more Automobiles and NGA networksMeanwhile, the number of lines more Automobiles fell for the first time in Espaà ± a (-1.9 million lines) lines and park lies ³ 50.7 million (excluding M2M and datacards) 3.7% less than in 2011. The prepaid segment was causing ³ this fall, down 12.5% ??(2.6 million lines) compared to 2011. By contrast, the volume of lines postpaid segment recorded a 2% increase, equivalent to 629 659 s more lines.

In addition, during 2012 ³ intensifies networks deploying new generation (NGA), with 63.7% more s of hits, which allow very high-speed connections. So that almost all accesses were restated HFC DOCSIS 3.0 technology and continues the momentum ³ deployment of optic fiber to the home (FTTH). Access DOCSIS 3.0 technology installed exceeded 9.6 million and totaled 3.2 million FTTH (of which 336 719 were active were almost double that of the year ± o 2011).

As for sharingof lines by speeds, continuous increasing contratacià ³ ³ n of higher speeds favored by improvements in access networks carried out by the operators. At end of year ± or, 63% (7.2 million) of the employed lines had a nominal speed of 10 Mbps or higher versus 54% of the year ± or earlier, while 10.5% of the lines â €? most milliona 1.2 s???? Tena-at a speed of 30 Mbps or more s.

fixed broadband Park overcame the 11.5 million lines, with an annual growth rate of 3.2% to reach a penetration of 25% n. 352 031 were incorporated new broadband lines of alternative operators xDSL captured 70%.

Access Report.

Did you like this article?

Subscribe to our

No comments:

Post a Comment